Throughout the UAE and Saudi Arabia, governments moved decisively on rail, actual property, capital markets and company regulation. Unique interviews and data-led reviews additionally make clear shifting funding tendencies, from luxurious watches to property and ports.

Make amends for 10 of the largest tales this week as chosen by Arabian Enterprise editors.

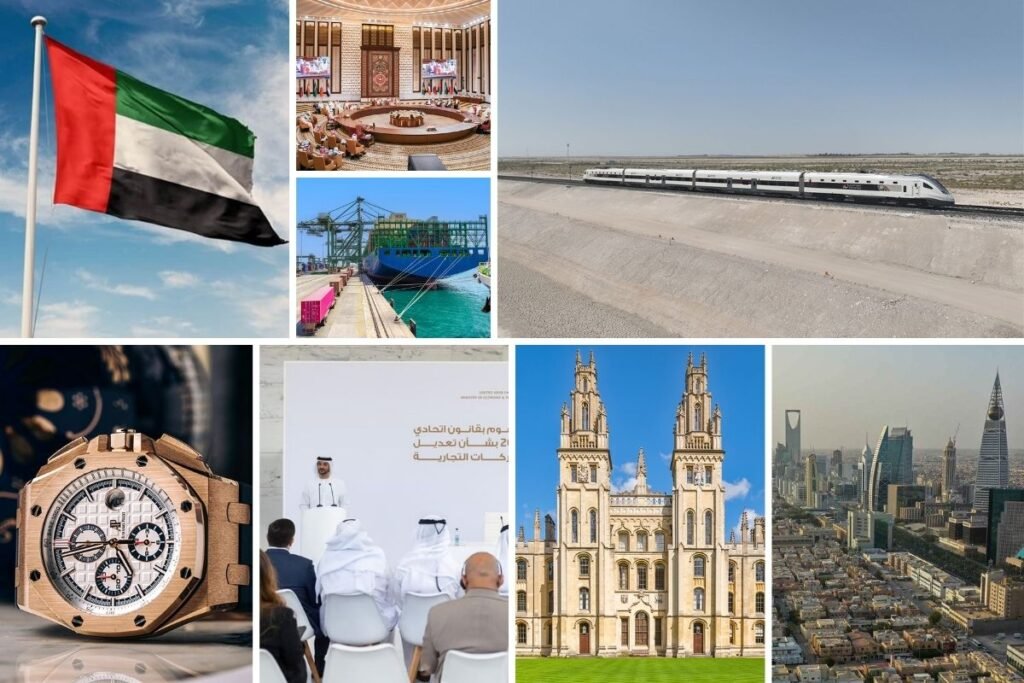

UAE passenger rail community: Etihad Rail reveals full nationwide system connecting 11 cities forward of 2026 launch

Etihad Rail has introduced full particulars of the UAE’s nationwide passenger railway community, marking a serious milestone within the nation’s transport and infrastructure growth.

The challenge will ship the UAE’s first absolutely built-in nationwide passenger rail system, connecting 11 cities and areas by way of strategically situated stations. The community is designed to strengthen connectivity throughout the Emirates and supply secure, dependable mobility companies for residents, residents and guests.

In early 2025, Etihad Rail introduced the primary 4 passenger stations in Abu Dhabi, Dubai, Sharjah and Fujairah. The corporate has now confirmed the remaining deliberate stations in Al Sila’, Al Dhannah, Al Mirfa, Madinat Zayed, Mezaira’a, Al Faya and Al Dhaid. These stations will grow to be operational in phases.

EXCLUSIVE: Saudi World Ports unveils $933m growth to problem UAE transshipment dominance

Saudi World Ports is investing 3.5 billion Saudi riyals ($933 million) over the following 5 years as a part of a strategic push to seize gateway cargo that has historically flowed by way of Jebel Ali and Abu Dhabi.

The operator of Dammam port is ploughing funds into container terminals, multi-purpose services and a brand new built-in logistics zone to use geographic benefits over Emirati rivals as the dominion’s non-oil financial system expands.

Chief government Rob Harrison advised Arabian Enterprise the funding represents part three within the firm’s evolution from port operator to ecosystem developer, positioning Saudi World Ports to serve the dominion’s 36 million shoppers extra straight than transshipment-focused rivals.

Saudi Arabia to formally open property market to foreigners as long-awaited legislation takes impact this month

Saudi Arabia will this month formally open components of its actual property market to overseas patrons, bringing into pressure a long-awaited legislation that enables non-Saudis to personal property in designated areas of the Kingdom.

The brand new Regulation on Non-Saudis’ Possession of Actual Property, authorised by royal decree final yr and printed within the official gazette in July 2025, got here into impact on January 21 following a six-month transition interval. This marks one of the important structural shifts within the Kingdom’s property market in a long time and is intently aligned with the federal government’s broader financial diversification agenda beneath Imaginative and prescient 2030.

For months earlier than the legislation was formally authorised, builders, traders and advisers had been intently monitoring its progress, with expectations constructing that Saudi Arabia would finally comply with different Gulf markets in easing restrictions on overseas possession. Whereas overseas funding in Saudi actual property has been permitted in restricted types since 2000, the brand new laws replaces that older framework with clearer guidelines, wider eligibility and stricter enforcement.

Dubai actual property holds agency in 2025 as costs, rents and ROI climb: prime areas revealed

The Dubai actual property sector remained firmly on a progress trajectory in 2025, supported by regular demand and increasing provide, in accordance with the Annual Dubai Property Market Report launched by dubizzle.

The report factors to sustained transactional exercise and total stability throughout key segments, together with prepared properties, off-plan gross sales and short-term leases, reinforcing confidence throughout Dubai’s residential market.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and dubizzle and CEO of Dubizzle Group MENA, mentioned: “Dubai’s actual property market saved up its momentum all year long, with regular demand throughout the board. We’ve additionally seen the trade evolve, supported by stronger regulation, new partnerships and rising improvements like actual property tokenisation, that are including extra confidence and depth to the market.”

UAE holidays 2026: The best way to get 45 days off with simply 17 of annual go away, anticipated Eid dates revealed

The UAE began 2026 with an official vacation for the private and non-private sector on Thursday, January 1.

The Gregorian New Yr is only one of many official public holidays legislated in Cupboard Decision No. (27) of 2024 In regards to the Public Holidays within the State within the UAE. The ruling identifies the official UAE holidays noticed throughout the nation yearly.

The UAE has introduced potential vacation dates for events resembling Eid Al Fitr, Eid Al Adha, the Islamic New Yr and Nationwide Day in 2026. By reserving annual go away strategically, it will likely be doable to have 45 days off and a number of full weeks of trip for just some days of annual go away.

UAE overhauls Business Firms Regulation with new possession and switch guidelines

The UAE Ministry of Financial system and Tourism has outlined main amendments to the nation’s Business Firms Regulation, introducing far-reaching reforms aimed toward strengthening enterprise flexibility, lowering prices and enhancing the nation’s funding enchantment.

At a media briefing reviewing Federal Decree-Regulation No. 20 of 2025, which amends Federal Decree-Regulation No. 32 of 2021, officers confirmed that the adjustments span 15 articles and introduce a brand new provision regulating the switch of an organization’s registration within the industrial register whereas preserving its authorized id.

Abdulla bin Touq Al Marri, Minister of Financial system and Tourism mentioned the UAE continues to pursue a long-term, forward-looking imaginative and prescient to construct a sophisticated and pioneering enterprise atmosphere for firms of all sizes, aligned with international finest practices and guided by the nation’s management.

Saudi Arabia opens capital market absolutely to overseas traders from February 2026

Saudi Arabia will open its capital market absolutely to overseas traders from February 1, 2026, marking one of the important liberalisation steps within the Kingdom’s monetary market historical past.

The transfer removes long-standing restrictions on non-resident participation and is designed to deepen liquidity and entice extra worldwide capital. The announcement was made by the Capital Market Authority (CMA) following approval by the CMA Board of a brand new regulatory framework governing overseas funding within the Major Market.

Underneath the brand new framework, the Saudi capital market will probably be accessible to all classes of overseas traders for direct participation throughout all its segments, efficient from February 1, 2026.

EXCLUSIVE: Watches should not a ‘get-rich-quick’ funding however will be ‘higher than gold or money’ in 2026

The worldwide luxurious watch market stands at an inflection level as 2026 begins. After three years of corrections following the post-pandemic speculative peak, the trade is displaying early indicators of stabilisation but the funding panorama for watches has shifted considerably.

“Consider watches much less like shares and extra like transportable wealth. They work finest as a retailer of worth with the potential to understand over time, not as a get-rich-quick funding,” Robertino Altiero, CEO of WatchGuys.com, mentioned in an unique interview with Arabian Enterprise.

Based on consultants, the market now rewards selectivity over hypothesis and heritage over hype. For traders within the Gulf area the place discretion and long-term wealth preservation has trumped short-term features, the present atmosphere presents challenges and alternatives.

UAE restricts scholarships for residents learning at British universities amid radicalisation fears

The United Arab Emirates (UAE) has restricted authorities funding for its residents wishing to check at British universities, in accordance with a report by the Monetary Instances.

In June, the UAE’s greater training ministry printed an inventory of world universities for which scholarships can be authorised and {qualifications} licensed, as a part of reforms limiting funding to top-performing establishments. The checklist included universities within the US, Australia, Israel and France, however excluded the UK, residence to most of the world’s main educational establishments.

The exclusion is linked to UAE considerations over what it perceives as the danger of Islamist radicalisation on UK campuses, in accordance with three folks accustomed to the matter cited by the FT.

A brand new Gulf order? What December’s Bahrain summit tells us about the way forward for the GCC

On the floor, the Bahrain summit seemed like another Gulf gathering. A well-recognized household {photograph}. Ornate reception halls. A closing communiqué thick with references to brotherly relations and shared future. But behind the choreography, one thing extra critical was happening.

For the primary time in years, all of the transferring components of Gulf integration – customs, aviation, rail, safety, even actual property regulation – had been pulled in a single course and given deadlines. Piece by piece, the summit revealed a bloc discovering its full rhythm – not by proclamation, however by way of the regular, technical self-discipline of shared programs. The Supreme Council’s assertion on December 3 was unequivocal on one level. The safety of the GCC states is “indivisible” and “any aggression towards any certainly one of them is an aggression towards all of them.”

It explicitly linked this to the joint defence settlement and King Salman’s long-running imaginative and prescient to maneuver the bloc from free cooperation in direction of one thing nearer to a union. It additionally pushed ministers to finish the remaining steps of financial unity, from the customs union to a typical marketplace for companies, and to report again on a “outlined timetable”.