South Korea’s monetary authorities are reportedly contemplating introducing a system that enables regulators to conduct pre-emptive crypto account freezes to cease digital asset value manipulation.

FSC Mulls Crypto Account Freezing System

On Tuesday, an area information media outlet reported that the Monetary Companies Fee (FSC) is discussing introducing a system to stop suspects from hiding or withdrawing unrealized income from market manipulation associated to crypto belongings.

In a January 6 assembly, the regulators revealed that they’ve been discussing the matter since November, exploring the proposal for prosecution measures towards suspects of crypto asset value manipulation.

Based on Newsis, some officers think about that there is a want “to enhance the present Digital Asset Consumer Safety Act by implementing measures for the confiscation of felony proceeds or the preservation of restoration funds prematurely.”

The measure would limit fund outflows reminiscent of withdrawals, transfers, and funds from a crypto-related account suspected of acquiring illicit good points by means of typical market manipulation ways, together with pre-purchasing, repeated trades through automated buying and selling, shopping for at inflated costs, and profit-taking.

Below the present guidelines, authorities should get hold of court docket warrants to freeze belongings linked to crypto manipulation, which leaves no means to behave rapidly and stop asset concealment beforehand. One committee member reportedly referenced the cost suspension system for inventory value manipulation, which was launched by means of the revision of the Capital Markets Act in April.

This technique noticed the primary home case of preemptively freezing accounts suspected of unfair buying and selling final September, when the Joint Activity Power for Eradicating Inventory Worth Manipulation imposed these measures on 75 accounts concerned in a KRW 100 billion inventory value manipulation case by a gaggle of rich people.

Some FSC officers allegedly emphasised that this method is critical for crypto belongings, arguing that they’re simpler to hide as soon as transferred to non-public wallets, with one noting that “at present, solely alternate deposits and withdrawals are blocked, whereas withdrawals to monetary establishments stay potential. Blocking these withdrawals would assist swiftly stop concealment.”

One other FSC member affirmed that “cost suspension is a step earlier than restoration preservation; it will be good if we might implement it proactively,” whereas others requested whether or not provisions associated to unfair buying and selling within the Capital Markets Act may be partially replicated within the Second Part of the Digital Asset Consumer Safety Act.

Second Part of SK’s Digital Asset Push

South Korea’s Second Part of the Digital Asset Consumer Safety Act was anticipated to be submitted on the finish of 2025. Nonetheless, it has been delayed till the start of 2026 as a result of an ongoing disagreement between the FSC and the Financial institution of Korea (BOK).

As reported by Bitcoinist, monetary authorities have been clashing over guidelines associated to the issuance and distribution of stablecoins, disagreeing on the extent of banks’ position within the issuance of won-pegged tokens.

The central financial institution has pushed for a consortium of banks proudly owning a minimum of 51% of any stablecoin issuer in search of approval within the nation. The FSC has shared issues that giving a majority stake to banks might scale back participation from tech companies and restrict the market’s innovation.

Regardless of the delay, the primary insurance policies of the crypto framework have reportedly been determined. Notably, the FSC’s draft will embody investor safety measures reminiscent of no-fault legal responsibility for crypto asset operators and isolation of chapter dangers for stablecoin issuers.

The invoice is predicted to require crypto asset operators to adjust to disclosure obligations in addition to phrases and circumstances. As well as, “impose strict legal responsibility for damages on digital asset operators in accordance with the Digital Monetary Transactions Act in instances of hacking or pc system failures.”

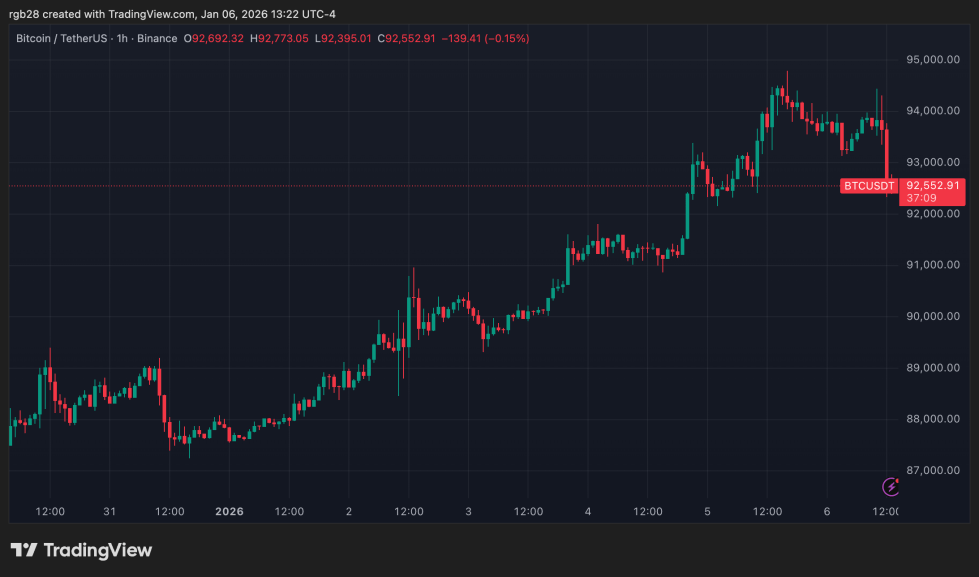

Bitcoin (BTC) trades at $92,552 within the one-week chart. Supply: BTCUSDT on TradingView

Featured Picture from Unsplash.com, Chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.