The Bitcoin worth appears to be off to an amazing begin, having spent a lot of the new 12 months above the psychological $90,000 mark. Whereas the premier cryptocurrency has slowed down in latest days, there was a show of great bullish intent out there thus far in 2026.

Now, this newest present of optimism considerably contradicts latest predictions that the Bitcoin worth could be in the beginning of a bear market. This begs the query — may the bull run be nearing a restart, or is the value of BTC solely witnessing a aid rally?

BTC’s Latest Bounce A Mere Bear Market Aid Rally — Analyst

In a January 9 submit on the X platform, crypto analyst Maartunn shared fascinating knowledge factors to reply the query of whether or not Bitcoin’s newest worth bounce is significant or only a aid rally. The market pundit anchored their reply on each on-chain and technical worth knowledge.

Firstly, Maartunn acknowledged that the latest bounce was solely certain to occur, because the Bitcoin worth discovered help across the ETF Realized Value at $85,000. This worth degree represents the typical price base of BTC ETF traders, and as anticipated, the patrons defended their positions — resulting in the value bounce.

This phenomenon is spotlighted by one other on-chain metric, the Coinbase Premium Hole, which measures the distinction between the Bitcoin worth on Coinbase and world exchanges. In line with Maartunn, the metric began to rise proper after New Yr’s Eve, signaling renewed shopping for exercise from US-based traders.

Moreover, the spot exchange-traded funds began seeing robust capital inflows days after this uptick within the Coinbase Premium Hole. “This appears extra like strategic shopping for/portfolio rebalancing (new quarter, new 12 months) than emotional FOMO,” Maartunn added.

Supply: @JA_Maartun on X

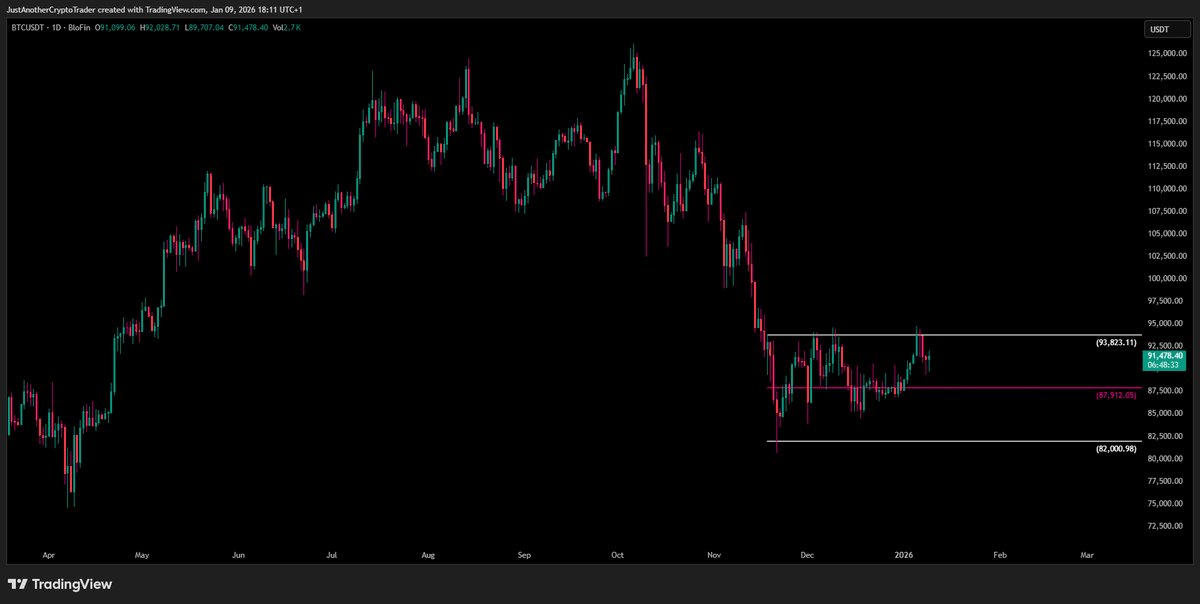

Nevertheless, the crypto analyst famous that the rally solely noticed the Bitcoin Value climb to the excessive vary of $94,000 earlier than getting rejected. In essence, this means that the flagship cryptocurrency doesn’t possess the bullish energy to breach that resistance.

Moreover, Maartunn talked about that Bitcoin continues to be buying and selling beneath essential on-chain ranges just like the Quick-Time period Holder Realized Value and Whale Realized Value, each of that are appearing as important overhead resistance.

The on-chain analyst famous that the on-chain observations counsel that this latest bounce is merely a bear market aid rally, not a pattern continuation — despite the fact that the value is up by about 10%. Solely a clear break and sustained shut above the $94,000 would point out the Bitcoin worth’s robust intent to rebuild a bullish construction, Martunn concluded.

Bitcoin Value At A Look

As of this writing, the value of BTC stands at $90,360, reflecting an nearly 1% decline up to now 24 hours.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.