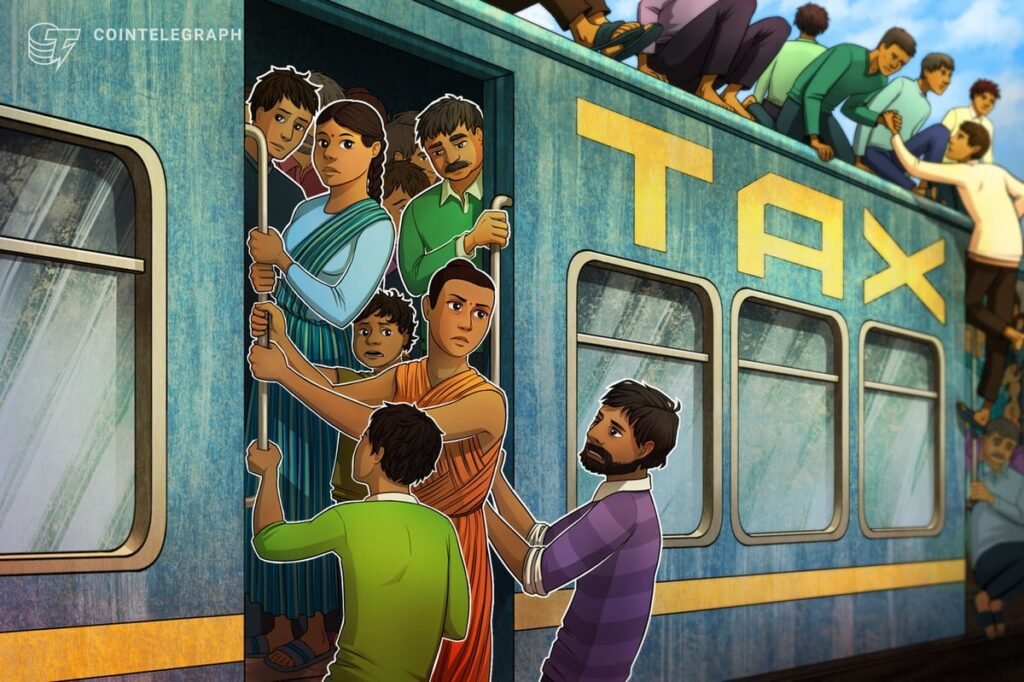

Monetary authorities in India have reiterated considerations over cryptocurrency transactions, warning that they could complicate tax enforcement.

India’s Earnings Tax Division (ITD), underneath the Central Board of Direct Taxes (CBDT), flagged main dangers linked to crypto exercise throughout a parliamentary standing committee on finance, The Instances of India reported on Thursday.

The warning got here throughout a Wednesday parliamentary committee assembly involving a number of companies, together with the Monetary Intelligence Unit (FIU), the Division of Income, and the CBDT, which discussed the report “A Examine on Digital Digital Property (VDAs) and Means Ahead.”

The ITD highlighted challenges posed by offshore exchanges, non-public wallets and decentralized finance (DeFi) instruments, which make detecting taxable earnings harder.

Involvement of a number of jurisdictions complicates tax enforcement

On the committee assembly, ITD officers reportedly flagged how “nameless, borderless and near-instant” worth transfers with crypto may permit one to maneuver funds with out regulated monetary intermediaries.

The authority additionally pointed to jurisdictional challenges posed by offshore VDA exercise. With a number of jurisdictions concerned, monitoring transactions and figuring out holders for tax functions is “just about unimaginable,” the ITD reportedly stated.

“Though there have been efforts in latest months on info sharing, it stays troublesome, inhibiting the flexibility of tax officers to undertake correct evaluation and reconstruction of transaction chains,” the report famous.

India levies a flat 30% tax on crypto positive aspects

India levies a flat 30% tax on all earnings from crypto asset exercise, together with a 1% tax deducted at supply (TDS) utilized to all transfers, whether or not worthwhile or not.

Whereas India formally permits cryptocurrency buying and selling underneath this heavy tax regime and authorized the return of main US change Coinbase in 2025, the federal government’s general stance in the direction of crypto stays cautious and blended.

Native executives have beforehand famous that India’s crypto ecosystem is at a pivotal stage, with adoption rising and the FIU approving 49 crypto exchanges in fiscal 12 months 2024–2025.

Associated: India’s central financial institution urges international locations to prioritize CBDCs over stablecoins

Nevertheless, the present tax framework creates challenges, as losses on crypto transactions should not acknowledged, producing “friction moderately than equity,” CoinSwitch co-founder Ashish Singhal reportedly said.

Journal: How crypto legal guidelines modified in 2025 — and the way they will change in 2026