- Ali rejects claims that airline offered beneath plane worth.

- Says govt to obtain 7.5% in money, 25% in fairness worth.

- Rs125bn to be reinvested in airline: PM’s privatisation aide.

ISLAMABAD: Rejecting criticism over the privatisation of Pakistan Worldwide Airways (PIA), Prime Minister’s Adviser on Privatisation Muhammad Ali on Tuesday stated that the transfer doesn’t undermine nationwide delight however goals to revive the service’s misplaced energy and effectivity.

Addressing a joint press convention with Federal Data Minister Atta Tarar, Muhammad Ali stated that claims circulating on social media suggesting that the airline was offered for lower than the worth of its plane had been incorrect and deceptive, including that such assertions don’t mirror the info of the privatisation course of.

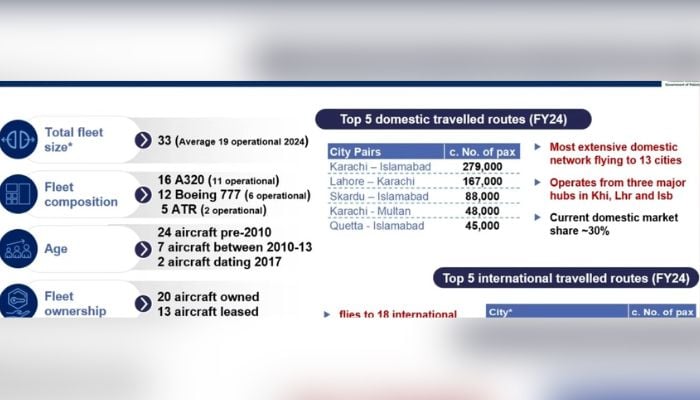

He stated that PIA as soon as operated a fleet of round 50 plane, however presently solely 17 to 19 planes are operational, whereas 12 plane are on lease.

The remarks got here a day after a consortium led by Arif Habib Company emerged as the highest bidder for a 75% stake within the nationwide service, providing Rs135 billion in what authorities hailed as a landmark second.

Ali stated PIA facilitates journey for round 4 million passengers yearly, describing its touchdown and route rights as its most dear property.

He added that PIA was as soon as a powerful and respected airline, and expressed confidence that privatisation would step by step assist restore its misplaced stature and operational energy.

The adviser additionally addressed the claims that the federal government would solely get Rs10 billion from the PIA’s privatisation, stating that the federal government would get 7.5% in money and 25% in fairness’s worth — amounting to Rs10 billion and 45 billion, respectively.

He stated the federal government would obtain a complete of Rs55 billion from the bidding proceeds, whereas Rs125 billion can be reinvested in PIA.

“PIA privatisation has been efficiently accomplished, and all the nation witnessed the clear course of.”

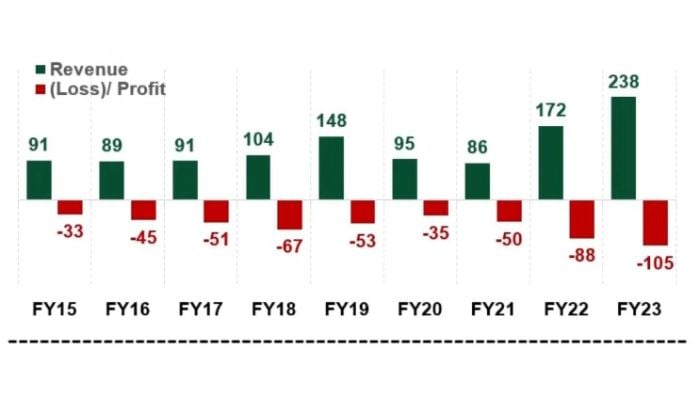

On the airline’s monetary decline, the adviser stated PIA’s efficiency deteriorated considerably after 2009. He revealed that the nationwide service incurred losses of Rs500 billion over the previous 10 years.

Individually, Ali instructed Reuters in a web based interview that the state expects a brand new proprietor to be operating the airline by April, topic to approvals.

The method now strikes to ultimate approvals by the Privatisation Fee board and the cupboard, anticipated inside days, with contract signing doubtless inside two weeks and monetary shut after a 90-day interval to satisfy regulatory and authorized circumstances.

The deal was structured to inject recent capital into the airline quite than merely switch possession, he stated. “We didn’t desire a scenario the place the federal government sells the airline, takes its cash, and the corporate nonetheless collapses,” Ali stated.

Furthermore, the Privatisation Fee Board (PC Board), in its 246th assembly held as we speak underneath the chairmanship of PM’s aide Ali, advisable the bid supply submitted by the Arif Habib Consortium for consideration and approval by the Cupboard Committee on Privatisation.

The Board famous with satisfaction the bid quantity of Rs. 135 billion, obtained towards the reference value of Rs. 100 billion, for a 75% stake of PIA.

The Board additionally acknowledged the efforts of all stakeholders concerned within the transaction, together with the Monetary Adviser and the Privatisation Fee’s transaction crew.

The Board additional recommended the management of the Adviser to the Prime Minister on Privatisation in steering the transaction to its ultimate stage.

PIA public sale

The public sale held on Tuesday marked Pakistan’s first main privatisation in practically twenty years and comes amid strain to reform loss-making state corporations underneath a $7 billion Worldwide Financial Fund (IMF) programme.

Arif Habib and Fortunate Cement consortia superior to the open public sale stage after putting gives above the reference value of Rs100 billion, whereas non-public airliner Airblue exited the bidding after submitting a suggestion of Rs26.5 billion.

Within the first spherical of the open public sale, Fortunate Cement Restricted–led consortium elevated its earlier bid of Rs101.5 billion to Rs115.5 billion. The spherical concluded with Arif Habib rising its bid to Rs121 billion, whereas Fortunate Cement closed the session with a suggestion of Rs120.25 billion.

The organisers then introduced a 30-minute recess on the request of Fortunate Cement.

Latter, Fortunate Cement elevated its bid to Rs134bn, instantly adopted by a counteroffer of Rs135bn from Arif Habib.