Tom Lee, chairman of Ethereum treasury agency Bitmine, has requested shareholders to approve a proposal to extend the corporate’s approved shares to 50 billion. This “dramatic” enhance within the share rely, which is at present at 50 million, is aimed toward holding the BMNR inventory engaging for retail traders.

Why BitMine Approved Shares Want To Improve: Tom Lee

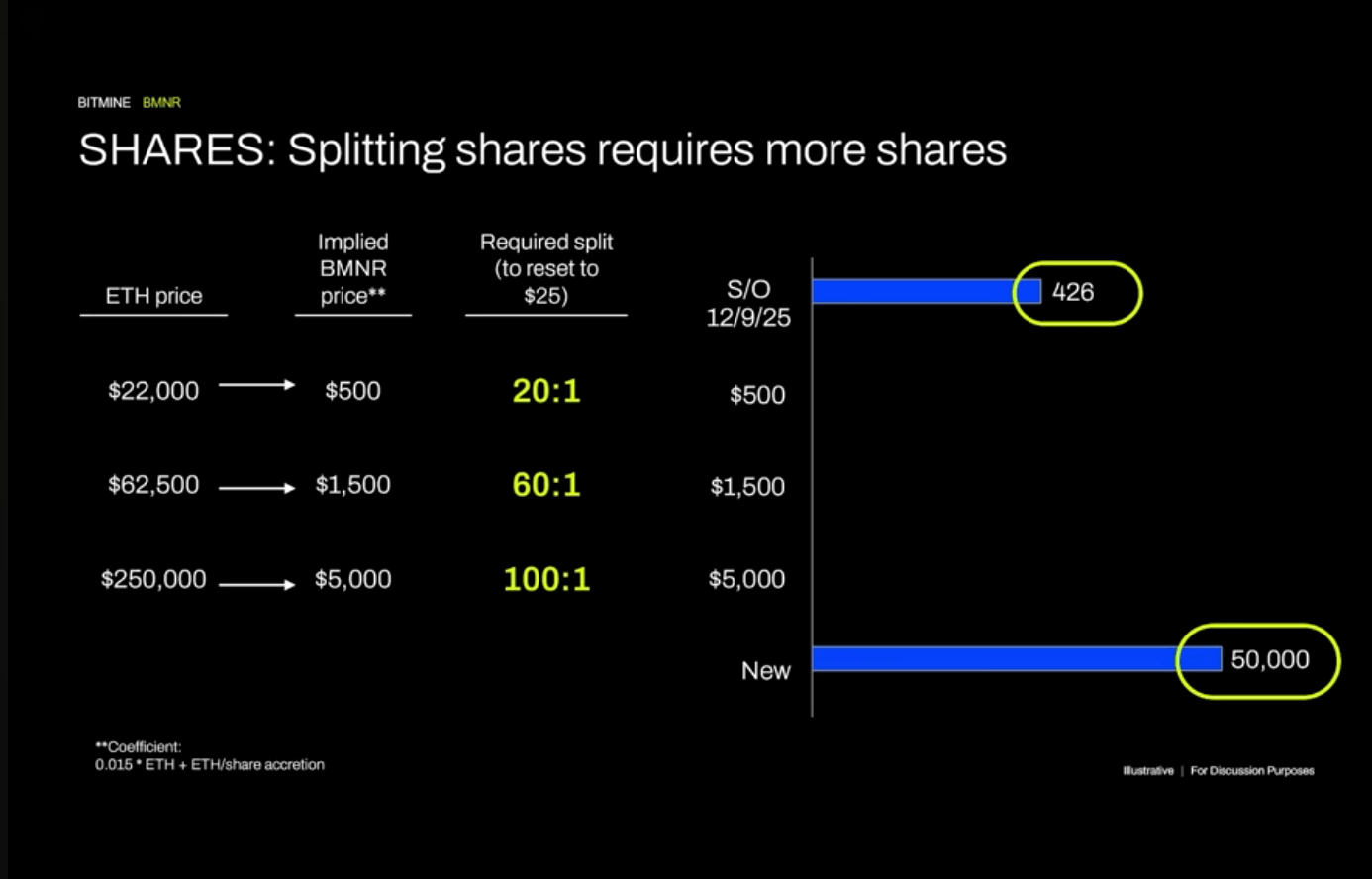

In and up to date YouTube message, Lee urged shareholders to help the movement to extend the variety of BitMine shares considerably. Based on the chairman, this enhance would most significantly tackle the potential want for future share splits as BMNR’s value tracks the worth of Ethereum.

Utilizing the Ethereum/Bitcoin ratio, Lee postulated varied potential future valuations for the worth of Ether. The BitMine Chairman’s mannequin exhibits that the ETH value might attain $250,000 if Bitcoin surges to $1,000,000, particularly as tokenization continues to attract institutional consideration to the Ethereum blockchain.

Within the occasion that Ethereum reaches a valuation of $250,000, Lee’s mannequin places the BitMine inventory at an implied value of about $5,000 per share, a value thought-about too excessive for many retail traders. “Not all people needs a inventory value at $500, $1,500, or $5,000. Most individuals need shares to remain at round $25,” Lee stated within the YouTube message.

This argument relies on the unit bias downside, a psychological idea the place consumers lean extra in the direction of shopping for a complete unit of an asset as a substitute of a fractional amount. Resulting from this cognitive bias, traders are enticed extra by quite a few items of “low-cost” shares reasonably than proudly owning fractional items of shares with higher underlying worth or ROI (return on funding) potential.

Supply: BitMine/YouTube

Moreover, Lee defined that if ETH hits $250,000, BitMine must provoke a 100:1 inventory break up to keep up a share value of $25. The chairman stated this share break up would create 43 billion shares excellent.

Lee famous:

The present shares excellent are 426 million, and we try to get the approved share rely to 50 billion. That does not imply we’re issuing 50 billion shares. That is what we wish the full most shares to be.

The BitMine chairman additionally highlighted capital market actions and opportunistic acquisitions as different the explanation why the Ethereum treasury agency wants to extend its approved share rely to 50 billion. The shareholders’ deadline to vote on the proposal is January 14, 2026.

After shifting its focus from Bitcoin mining to Ethereum treasury in 2025, BitMine has gone on to turn out to be the biggest company holder of Ether. The BMNR inventory closed the day at a valuation of $31.19, reflecting an virtually 15% acquire on Friday.

Ethereum Value At A Look

As of this writing, the worth of ETH stands at round $3,110, reflecting an over 3% soar up to now 24 hours.

The worth of ETH on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from Ilya S. Savenok/Getty Photos, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.