Chainlink co-founder Sergey Nazarov argues that the latest crypto market downturn is in contrast to any earlier bear market — there have been no main FTX-style collapses, and tokenized real-world asset (RWA) progress stays substantial.

Market cycles are regular, “however what’s essential is what these cycles reveal about how far the business has progressed,” said Nazarov on X on Tuesday.

Crypto market capitalization has fallen 44% from its October all-time excessive of $4.4 trillion, with nearly $2 trillion exiting the house in simply 4 months.

Nazarov, nevertheless, didn’t seem involved, highlighting two main components that separate this present bear market from earlier ones.

In contrast to earlier cycles, such because the FTX and crypto-lending failures in 2022, there have not been main institutional collapses throughout this drawdown, indicating the business can now deal with volatility extra reliably, he stated.

“There have been no massive danger administration failures resulting in massive institutional failures or widespread systemic dangers.”

RWA progress will drive establishments and infrastructure

Secondly, RWA tokenization and on-chain perpetual contracts for conventional commodities proceed to speed up no matter crypto costs, proving this innovation has standalone worth past hypothesis.

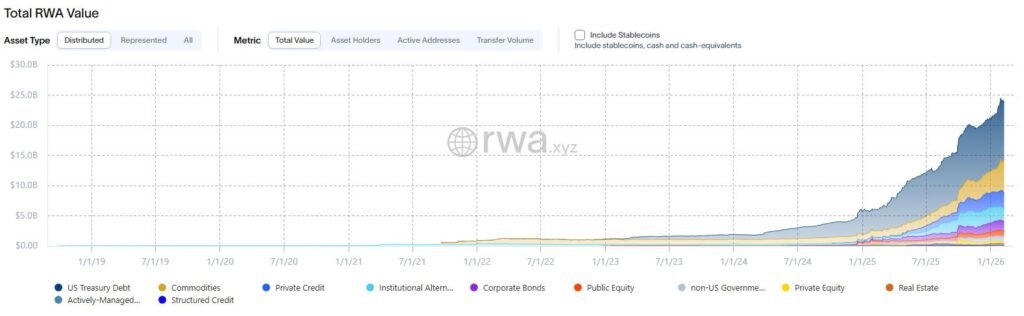

Tokenized RWA onchain worth has elevated 300% over the previous 12 months, in keeping with RWA.xyz.

This indicators that having real-world belongings on-chain “isn’t tightly coupled to cryptocurrency costs however gives its personal distinctive worth that may develop no matter market pricing of Bitcoin or different crypto belongings,” he stated.

The surge hasn’t been mirrored within the worth of Chainlink (LINK), nevertheless, with the blockchain oracle and RWA-centric asset tanking 67% since its October peak and down 83% since its 2021 all-time excessive, buying and selling at a bear-market low under $9 on the time of writing.

Associated: Crypto VC Funding Doubled in 2025 as RWA Tokenization Took the Lead

Nazarov additionally sees different converging tendencies reshaping the way forward for crypto.

On-chain perps and tokenization provide distinctive worth, corresponding to 24/7 markets, on-chain collateral, and real-time knowledge, which is rising steadily. Institutional adoption might be pushed by this basic utility, and infrastructure demand will rise as advanced RWAs require extra refined on-chain programs, the Chainlink co-founder stated.

“If these tendencies proceed, I imagine what I’ve been saying for years will occur; on-chain RWAs will surpass cryptocurrency within the complete worth in our business, and what our business is about will essentially change.”

Not all bear markets are equal

Bernstein analyst Gautam Chhugani echoed the sentiment in a word on Monday, writing that we’re experiencing “the weakest Bitcoin bear case in its historical past.”

“The present Bitcoin worth motion is a mere disaster of confidence. Nothing broke, no skeletons will present up,” analysts led by Chhugani stated.

Jeff Mei, chief working officer on the BTSE trade, informed Cointelegraph that this sell-off is totally different “in that it was precipitated largely by non-crypto catalysts.”

These embrace fears {that a} faltering AI tech increase may trigger shares to crash, “compounded by the appointment of Kevin Warsh to Fed chair, who many imagine will cut back liquidity within the monetary system,” he stated.

Journal: Bitcoin problem plunges, Buterin sells off Ethereum: Hodler’s Digest