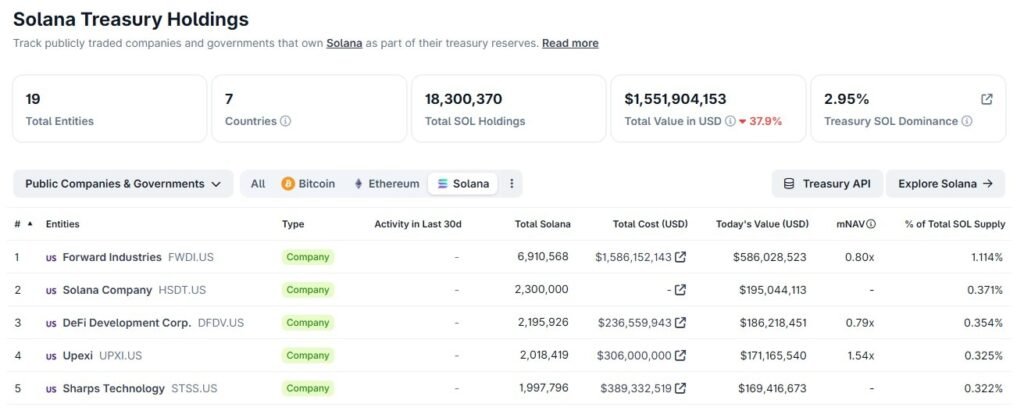

Publicly listed corporations that maintain Solana as a treasury asset are sitting on greater than $1.5 billion in unrealized losses, based mostly on disclosed acquisition prices and present market costs tracked by CoinGecko.

The losses are concentrated amongst a small group of United States-listed corporations that collectively management over 12 million Solana (SOL) tokens, about 2% of the full provide. Whereas losses stay unrealized, fairness markets have already repriced the businesses, with most buying and selling nicely under the market worth of their tokens.

CoinGecko knowledge reveals that Ahead Industries, Sharps Expertise, DeFi Improvement Corp and Upexi account for over $1.4 billion in disclosed unrealized losses. The entire is probably going understated, as Solana Firm has not absolutely disclosed its acquisition prices.

The figures spotlight a rising hole between paper losses and liquidity strain. Whereas not one of the corporations have been compelled to promote their SOL, compressed web asset worth (mNAV) multiples and falling share costs have constrained their capacity to boost recent capital.

Accumulation stalls throughout Solana treasuries

Transaction knowledge compiled by CoinGecko reveals that the majority of SOL accumulation occurred between July and October 2025, when a number of corporations made massive, concentrated purchases.

Since then, not one of the high 5 Solana treasury corporations have disclosed significant new purchases, and no on-chain gross sales have been recorded.

Ahead Industries, the most important holder, accrued over 6.9 million SOL at a mean value of about $230. With SOL buying and selling round $84, Ahead has unrealized losses of over $1 billion.

Sharps Expertise made a single $389 million buy close to the market peak. The corporate’s SOL is now price about $169 million, down over 56% from its acquisition value.

DeFi Improvement Corp followed a extra gradual accumulation technique and studies smaller losses, however its shares nonetheless commerce under the worth of its SOL holdings.

Solana Firm, which built a 2.3 million SOL place over a number of tranches of purchases, has additionally paused accumulation since October, in accordance with CoinGecko’s transaction historical past.

Associated: Kyle Samani leaves Multicoin in ‘bittersweet second’ to discover new tech

Fairness markets sign a treasury winter

Fairness worth knowledge from Google Finance reveals that the highest 5 Solana treasury corporations have suffered sharp drawdowns within the final six months, considerably underperforming SOL itself.

Ahead Industries, DeFi Improvement Corp, Sharps Expertise and Solana Firm inventory costs are down between 59% and 73% within the six-month charts.

CoinGecko knowledge shows that Upexi has $130 million in unrealized losses on its SOL holdings. Nonetheless, its shares have fallen extra sharply than its friends.

Upexi shares are down greater than 80% over the previous six months, accordingly it Google Finance. Like different Solana treasury corporations, Upexi has paused new accumulation since September.

Journal: Crypto loves Clawdbot/Moltbot, Uber rankings for AI brokers: AI Eye