- Two-month extension granted at 6.5%.

- Deposit assured; formal approval nonetheless awaited.

- Longer rollover wanted IMF talks.

ISLAMABAD: The United Arab Emirates has agreed to a short-term rollover of a $2 billion deposit for Pakistan for a interval of two months, The Information reported on Friday, as Islamabad prepares for talks with the Worldwide Financial Fund (IMF).

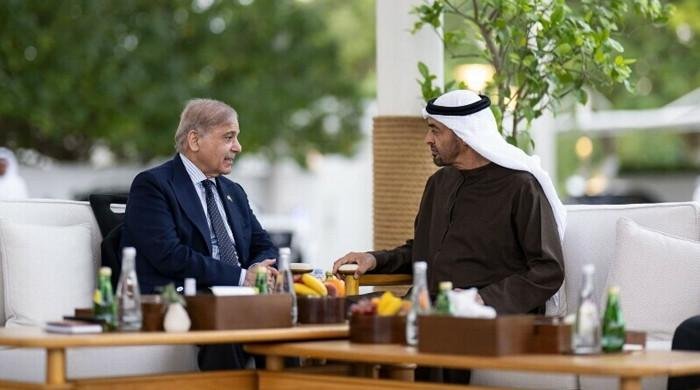

This assurance was given to Pakistan when Deputy Prime Minister and Overseas Minister Ishaq Dar contacted the UAE high-ups this week. A prime official confirmed that the UAE has agreed to the short-term rollover till April 17, 2026.

The event comes forward of Pakistan’s upcoming evaluate talks with the IMF for the third evaluate and the discharge of the $1 billion fourth tranche below the $7 billion Prolonged Fund Facility (EFF).

“The UAE has granted the rollover on a short-term foundation at a charge of 6.5%,” prime official sources mentioned, including that formal approval from the involved quarter was awaited and anticipated to be acquired anytime.

Replying to a question, the Overseas Workplace spokesperson mentioned that he was not conscious of the context or content material of the statements made on the Standing Committee on Finance by officers of the Ministry of Finance.

He might solely affirm that the deputy premier was seized of the matter and was enjoying a really constructive function in coordination and session with related authorities within the UAE.

“The tenure of the rollover is the prerogative of the depositor. By way of the constructive function of Dar, we will say that the rollover is assured and the tenure isn’t linked. For the reason that rollover continues, this matter stays in management,” the spokesperson mentioned.

He additionally referred to statements made by the finance minister that there was no exterior finance hole by way of Pakistan’s profile, together with with regards to the nation’s engagement with the IMF.

Earlier, the UAE had rolled over $2 billion for only one month, with $1 billion maturing on February 16 and the remaining $1 billion on February 22.

The federal government had requested the UAE to roll over the deposit for 2 years and subsequently submitted a contemporary request for extension of the power. It has been conveyed to the UAE that after the IMF evaluate talks, Islamabad will once more strategy the authorities to hunt a longer-term rollover of the deposits.

In January, the UAE had rolled over $2 billion for one month after the quantity matured. A 3rd tranche of $1 billion is because of mature in July 2026.

Throughout December, the Ministry of Finance had ready working papers and drafted a letter to the UAE authorities looking for rollover of the complete $3 billion for one 12 months. The federal government had hoped the rollover could be secured upfront, as in earlier cases, however the UAE initially agreed to solely a one-month extension.

Final week, officers from the Ministry of Finance have been unable to provide a transparent assurance to a parliamentary committee concerning the rollover of the complete $3 billion deposit, putting duty on the Ministry of Overseas Affairs.

The finance minister advised the committee that Pakistan has supplied the IMF with a transparent exterior financing plan and that talks with the UAE authorities have been persevering with. He mentioned bilateral preparations have been on observe and that any change within the state of affairs could be communicated.

In accordance with officers, the Abu Dhabi Fund for Improvement has positioned $3 billion with the State Financial institution of Pakistan in three separate tranches. Two tranches of $1 billion every matured on January 17 and January 23 and have been rolled over for one month, whereas the third tranche of $1 billion is because of mature in July and shall be taken up for rollover nearer to its maturity.

In December, Saudi Arabia agreed to increase the maturity of its $3 billion deposit with the State Financial institution of Pakistan by one other 12 months. Underneath a 2021 settlement, Riyadh had positioned $3 billion with Pakistan’s central financial institution.

For the present fiscal 12 months, Pakistan is looking for rollover of roughly $12 billion in exterior deposits, together with round $9 billion from Saudi Arabia and China — $5 billion from Saudi Arabia and $4 billion from China — along with the $3 billion positioned by the UAE.