The nuclear business is within the mist of a renaissance. Outdated vegetation are being refurbished, and buyers are showering startups with money. Within the final a number of weeks of 2025 alone, nuclear startups raised $1.1 billion, largely on investor optimism that smaller nuclear reactors will succeed the place the broader business has lately stumbled.

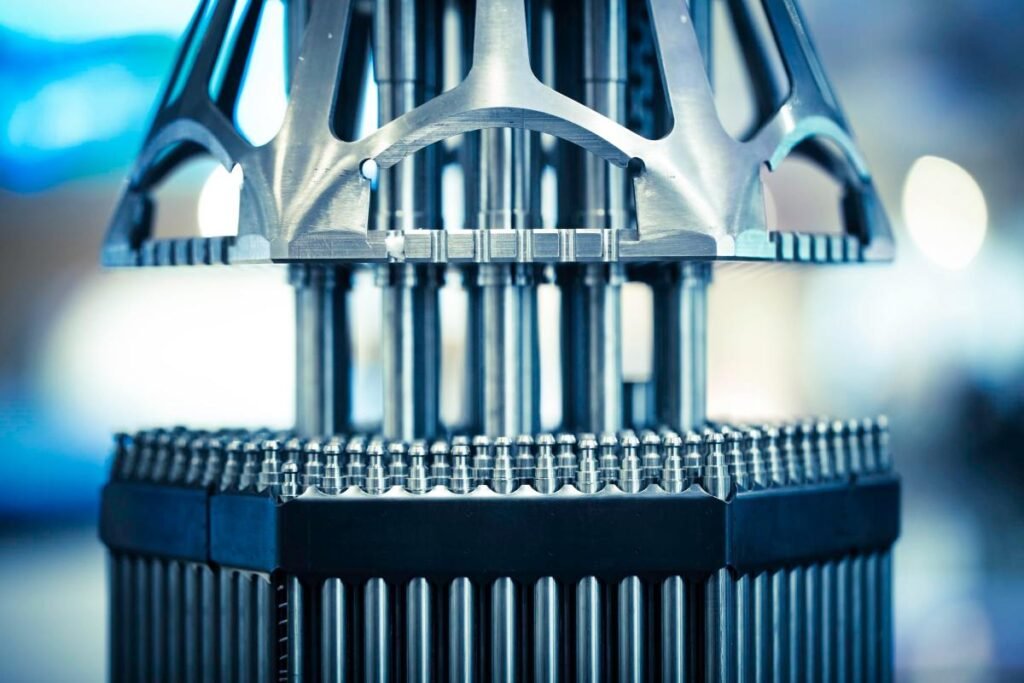

Conventional nuclear reactors are huge items of infrastructure. The most recent reactors constructed within the U.S. — Vogtle 3 and 4 in Georgia — include tens of 1000’s of tons of concrete, are powered by gasoline assemblies 14 ft tall, and generate over 1 gigawatt of electrical energy every. However they have been additionally eight years late and greater than $20 billion over funds.

The contemporary crop of nuclear startups hopes that by shrinking the reactor, they’ll have the ability to sidestep each issues. Want extra energy? Simply add extra reactors. Smaller reactors, they argue, may be constructed utilizing mass manufacturing strategies, and as firms produce extra components, they need to get higher at making them, which ought to drive down prices.

The magnitude of that profit is one thing specialists are still researching, however at this time’s nuclear startups are relying on it being larger than zero.

However manufacturing isn’t simple. Simply take a look at Tesla’s expertise: The corporate struggled mightily to profitably produce the Mannequin 3 in massive numbers — and it had the good thing about being within the automotive business, the place the U.S. nonetheless has important experience. U.S. nuclear startups don’t have that benefit.

“I’ve various buddies who work in provide chain for nuclear, and so they can rattle off like 5 to 10 supplies that we simply don’t make in the USA,” Milo Werner, normal associate at DCVC, informed TechCrunch. “We now have to purchase them abroad. We’ve forgotten make them.”

Werner is aware of a factor or two about manufacturing. Earlier than changing into an investor, she labored at Tesla main new product introduction, and earlier than that, she did the identical at FitBit, launching 4 factories in China for the wearables firm. Right now, along with investing at DCVC, Werner has co-founded the NextGen Trade Group, which works to advance the adoption of recent applied sciences within the manufacturing sector.

Techcrunch occasion

San Francisco

|

October 13-15, 2026

When firms of any dimension wish to manufacture one thing, they face two fundamental challenges, Werner stated. One is capital, which is usually the largest constraint since factories aren’t low cost. Thankfully for the nuclear business, that shouldn’t pose a lot of an issue. “They’re awash in capital proper now,” she stated.

However the nuclear business isn’t immune from the opposite problem all producers face, which is a scarcity of human capital. “We haven’t actually constructed any industrial services in 40 years in the USA,” Werner stated. Because of this, we’ve misplaced the muscle reminiscence. “It’s like we’ve been sitting on the sofa watching TV for 10 years after which getting up and attempting to run a marathon the following day. It’s not good.”

After many years of offshoring, the U.S. lacks individuals skilled with each manufacturing facility development and operations. “There are for positive some individuals in the USA who’ve been doing this, however we don’t have the quantum of folks that we want for everyone to have a full employees of seasoned manufacturing individuals.” She not simply speaking about machine operators, however everybody from manufacturing facility ground supervisors all the way in which as much as CFOs and board members.

The excellent news is that Werner sees a whole lot of startups, nuclear and in any other case, constructing early variations of their merchandise in shut proximity to their technical crew. “That’s pulling manufacturing in nearer to the USA as a result of it permits them to have that cycle of enchancment.”

To reap the advantages of mass manufacturing, it’s useful for startups of all stripes to start out small and scale up. “Actually leaning into modularity is essential for buyers,” she stated. The modular strategy helps firms begin producing small volumes early on to allow them to gather information on the manufacturing course of. Ideally, that information will present enchancment over time, which might put buyers comfortable.

The advantages of mass manufacturing don’t occur in a single day. Firms will usually forecast value reductions that may consequence from studying by means of manufacturing, however it may take longer than they anticipate. “Usually it takes years, like a decade, to get there,” Werner stated.